Chapter 3: Competing in the Global Marketplace

Learning Objectives

After reading this chapter, you should be able to answer these questions:

- Why is global trade important to Canada, and how is it measured?

- Why do nations trade?

- What are the barriers to international trade?

- How do governments and institutions foster world trade?

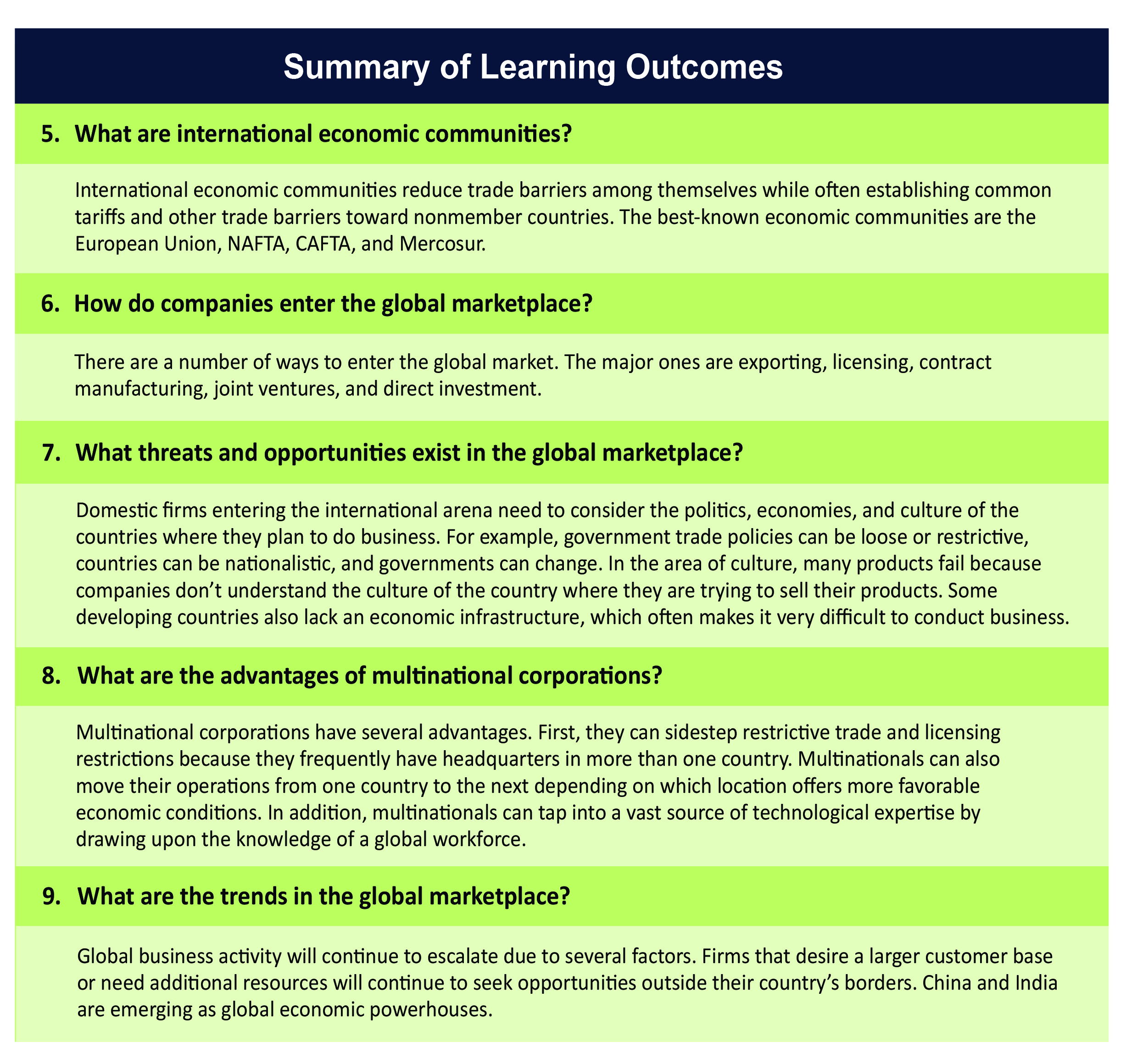

- What are international economic communities?

- How do companies enter the global marketplace?

- What threats and opportunities exist in the global marketplace?

- What are the advantages of multinational corporations?

- What are the trends in the global marketplace?

This chapter examines the business world of the global marketplace. It focuses on the processes of taking a business global, such as licensing agreements and franchisees; the challenges that are encountered; and the regulatory systems governing the world market of the 21st century.

Today, global revolutions are under way in many areas of our lives: management, politics, communications, and technology. The word global has assumed a new meaning, referring to a boundless mobility and competition in social, business, and intellectual arenas. The purpose of this chapter is to explain how global trade is conducted. We also discuss the barriers to international trade and the organizations that foster global trade. The chapter concludes with trends in the global marketplace.

3.1 Global Trade in Canada

Why is global trade important to Canada, and how is it measured?

No longer just an option, having a global vision has become a business imperative. Having a global vision means recognizing and reacting to international business opportunities, being aware of threats from foreign competitors in all markets, and effectively using international distribution networks to obtain raw materials and move finished products to the customer.

Canadian managers must develop a global vision if they are to recognize and react to international business opportunities, as well as remain competitive at home. Often a Canadian firm’s toughest domestic competition comes from foreign companies. Moreover, a global vision enables a manager to understand that customer and distribution networks operate worldwide, blurring geographic and political barriers and making them increasingly irrelevant to business decisions. Over the past three decades, world trade has climbed from $200 billion a year to more than $1.4 trillion.1

Go into a Paris McDonald’s and you may not recognize where you are. There are no Golden Arches or utilitarian chairs and tables and other plastic features. The restaurants have exposed brick walls, hardwood floors, and armchairs. Some French McDonald’s even have faux marble walls. Most restaurants have TVs with continuous music videos. You can even order an espresso, beer, and a chicken on focaccia bread sandwich. It’s not America.

The Impact of Terrorism on Global Trade

The terrorist attacks on America on September 11, 2001, and the Charlie Hebdo terrorist attacks in Paris in 2015 have changed the way the world conducts business. The immediate impacts of these events have included a short-term shrinkage of global trade. Globalization, however, will continue because the world’s major markets are too vitally integrated for globalization to stop. Nevertheless, terrorism has caused the growth to be slower and costlier.2

Companies are paying more for insurance and security for overseas staff and property. Heightened border inspections slow movements of cargo, forcing companies to stock more inventory. Tighter immigration policies curtail the liberal inflows of skilled and blue-collar workers that allowed companies to expand while keeping wages in check. The impact of terrorism may lessen over time, but multinational firms will always be on guard.3

Measuring Trade between Nations

International trade improves relationships with friends and allies; helps ease tensions among nations; and bolsters economies by raising people’s standard of living, providing jobs, and improving the quality of life. The value of international trade is over $16 trillion a year and growing. This section takes a look at some key measures of international trade: exports and imports, the balance of trade, the balance of payments, and exchange rates.

Exports and Imports

The developed nations (those with mature communication, financial, educational, and distribution systems) are the major players in international trade. They account for about 70 percent of the world’s exports and imports. Exports are goods and services made in one country and sold to others. Imports are goods and services that are bought from other countries.

Balance of Trade

The difference between the value of a country’s exports and the value of its imports during a specific time is the country’s balance of trade. A country that exports more than it imports is said to have a favourable balance of trade, called a trade surplus. A country that imports more than it exports is said to have an unfavourable balance of trade, or a trade deficit. When imports exceed exports, more money from trade flows out of the country than flows into it.

Balance of Trade video: https://youtu.be/GK66uQHVjlU

Balance of Payments

Another measure of international trade is called the balance of payments, which is a summary of a country’s international financial transactions showing the difference between the country’s total payments to and its total receipts from other countries. The balance of payments includes imports and exports (balance of trade), long-term investments in overseas plants and equipment, government loans to and from other countries, gifts and foreign aid, military expenditures made in other countries, and money transfers in and out of foreign banks.

Balance of payments video: https://youtu.be/ZVvkeyXKFHg

The Changing Value of Currencies

The exchange rate is the price of one country’s currency in terms of another country’s currency. If a country’s currency appreciates, less of that country’s currency is needed to buy another country’s currency. If a country’s currency depreciates, more of that currency will be needed to buy another country’s currency.

As the dollar depreciates, the prices of Japanese goods rise for Canadian residents, so they buy fewer Japanese goods—thus, Canadian imports decline. At the same time, as the dollar depreciates relative to the yen, the yen appreciates relative to the dollar. This means prices of Canadian goods fall for the Japanese, so they buy more Canadian goods—and Canadian exports rise.

Currency markets operate under a system called floating exchange rates. Prices of currencies “float” up and down based upon the demand for and supply of each currency. Global currency traders create the supply of and demand for a particular currency based on that currency’s investment, trade potential, and economic strength. If a country decides that its currency is not properly valued in international currency markets, the government may step in and adjust the currency’s value. In a devaluation, a nation lowers the value of its currency relative to other currencies. This makes that country’s exports cheaper and should, in turn, help the balance of payments.

3.2 Why Nations Trade

What are the advantages of trading?

One might argue that the best way to protect workers and the domestic economy is to stop trade with other nations. Then the whole circular flow of inputs and outputs would stay within our borders. But if we decided to do that, how would we get resources like bananas and coffee beans? Canada simply can’t produce some things, and it can’t manufacture some products, such as toys and most clothing, at the low costs we’re used to. The fact is that nations—like people—are good at producing different things: you may be better at balancing a ledger than repairing a car. In that case you benefit by “exporting” your bookkeeping services and “importing” the car repairs you need from a good mechanic. Economists refer to specialization like this as advantage.

Absolute Advantage

A country has an absolute advantage when it can produce and sell a product at a lower cost than any other country or when it is the only country that can provide a product.

Suppose that Canada has an absolute advantage in air traffic control systems for busy airports and that Brazil has an absolute advantage in coffee. Canada does not have the proper climate for growing coffee, and Brazil lacks the technology to develop air traffic control systems. Both countries would gain by exchanging air traffic control systems for coffee.

Absolute and comparative advantage video: https://youtu.be/hnGCjwRWtcw

Comparative Advantage

Even if Canada had an absolute advantage in both coffee and air traffic control systems, it should still specialize and engage in trade. Why? The reason is the principle of comparative advantage, which says that each country should specialize in the products that it can produce most readily and cheaply, and trade those products for goods that foreign countries can produce most readily and cheaply. This specialization ensures greater product availability and lower prices.

For example, India and Vietnam have a comparative advantage in producing clothing because of lower labour costs. Japan has long held a comparative advantage in consumer electronics because of technological expertise.

Thus, comparative advantage acts as a stimulus to trade. When nations allow their citizens to trade whatever goods and services they choose without government regulation, free trade exists. Free trade is the policy of permitting the people and businesses of a country to buy and sell where they please without restrictions. The opposite of free trade is protectionism, in which a nation protects its home industries from outside competition by establishing artificial barriers such as tariffs and quotas. In the next section, we’ll look at the various barriers, some natural and some created by governments, that restrict free trade.

Protectionism: https://youtu.be/Rylkrzn7A9g

The Fear of Trade and Globalization

The continued protests during meetings of the World Trade Organization and the convocations of the World Bank and the International Monetary Fund (the three organizations are discussed later in the chapter) show that many people fear world trade and globalization. What do they fear? The negatives of global trade are as follows:

- Millions of Canadians have lost jobs due to imports or production shifting abroad. Most find new jobs, but often those jobs pay less.

- Millions of others fear losing their jobs, especially at those companies operating under competitive pressure.

- Employers often threaten to export jobs if workers do not accept pay cuts.

- Service and white-collar jobs are increasingly vulnerable to operations moving offshore.

Sending domestic jobs to another country is called outsourcing, a topic you can explore in more depth. Many Canadian companies have set up call service centers in India, the Philippines, and other countries. Now even engineering and research and development jobs are being outsourced.

Benefits of Globalization

A closer look reveals that globalization has been the engine that creates jobs and wealth. Benefits of global trade include the following:

- Productivity grows more quickly when countries produce goods and services in which they have a comparative advantage. Living standards can increase faster. One problem is that big G20 countries have added more than 1,200 restrictive export and import measures since 2008.

- Global competition and cheap imports keep prices down, so inflation is less likely to stop economic growth. However, in some cases this is not working because countries manipulate their currency to get a price advantage.

- An open economy spurs innovation with fresh ideas from abroad.

- Through infusion of foreign capital and technology, global trade provides poor countries with the chance to develop economically by spreading prosperity.

- More information is shared between two trading partners that may not have much in common initially, including insight into local cultures and customs, which may help the two nations expand their collective knowledge and learn ways to compete globally.4

3.3 Barriers to Trade

What are the barriers to international trade?

International trade is carried out by both businesses and governments—as long as no one puts up trade barriers. In general, trade barriers keep firms from selling to one another in foreign markets. The major obstacles to international trade are natural barriers, tariff barriers, and nontariff barriers.

Natural Barriers

Natural barriers to trade can be either physical or cultural. For instance, even though raising cattle in the relative warmth of Argentina may cost less than raising cattle in the bitter cold of Siberia, the cost of shipping the beef from South America to Siberia might drive the price too high. Distance is thus one of the natural barriers to international trade.

Language is another natural trade barrier. People who can’t communicate effectively may not be able to negotiate trade agreements.

Tariff Barriers

A tariff is a tax imposed by a nation on imported goods. It may be a charge per unit, such as per barrel of oil or per new car; it may be a percentage of the value of the goods, such as 5 percent of a $500,000 shipment of shoes; or it may be a combination. No matter how it is assessed, any tariff makes imported goods more costly, so they are less able to compete with domestic products.

Protective tariffs make imported products less attractive to buyers than domestic products.

Arguments for and against Tariffs

The main arguments for tariffs include the following:

- Tariffs protect infant industries. A tariff can give a struggling new domestic industry time to become an effective global competitor.

- Tariffs protect Canadian jobs. Unions and others say tariffs keep foreign labour from taking away Canadian jobs.

- Tariffs aid in military preparedness. Tariffs should protect industries and technology during peacetime that are vital to the military in the event of war.

The main arguments against tariffs include the following:

- Tariffs discourage free trade, and free trade lets the principle of competitive advantage work most efficiently.

- Tariffs raise prices, thereby decreasing consumers’ purchasing power.

Trade Barriers video: https://youtu.be/c6xBo0_WCYU

Nontariff Barriers

Governments also use other tools besides tariffs to restrict trade. One type of nontariff barrier is the import quota, or limits on the quantity of a certain good that can be imported.

A complete ban against importing or exporting a product is an embargo.

3.4 Fostering Global Trade

How do governments and institutions foster world trade?

Antidumping Laws

Canadian firms don’t always get to compete on an equal basis with foreign firms in international trade. To level the playing field, Parliament has passed antidumping laws. Dumping is the practice of charging a lower price for a product (perhaps below cost) in foreign markets than in the firm’s home market. The company might be trying to win foreign customers, or it might be seeking to get rid of surplus goods.

When the variation in price can’t be explained by differences in the cost of serving the two markets, dumping is suspected. Most industrialized countries have antidumping regulations. They are especially concerned about predatory dumping, the attempt to gain control of a foreign market by destroying competitors with impossibly low prices.

The United States recently imposed tariffs on softwood lumber from Canada. Canada was found guilty of pricing softwood lumber at between 7.72 and 4.49 percent below their costs. U.S. customs officers will now levy tariffs on Canadian timber exports with tax rates from 17.41 percent to 30.88 percent, depending on the business.5

From our discussion so far, it might seem that governments act only to restrain global trade. On the contrary, some governments and international financial organizations work hard to increase it, as this section explains.

Trade Negotiations and the World Trade Organization

The Uruguay Round of trade negotiations is an agreement that dramatically lowers trade barriers worldwide. Adopted in 1994, the agreement has been now signed by 148 nations. As the most ambitious global trade agreement ever negotiated, the Uruguay Round reduced tariffs by one-third worldwide, a move that is expected to increase global income by $235 billion annually. Perhaps the most notable aspect of the agreement is its recognition of new global realities. For the first time, an agreement covers services, intellectual property rights, and trade-related investment measures such as exchange controls.

As a follow-up to the Uruguay Round, the negotiating round started in the capital of Qatar in 2001 is called the Doha Round. To date, the round has shown little progress in advancing free trade. Developing nations are pushing for the reduction of farm subsidies in the United States, Europe, and Japan. Poor countries say that the subsidies stimulate overproduction, which drives down global agricultural prices. Because developing nations’ primary exports are agricultural commodities, low prices mean that they cannot compete in the global marketplace. On the other hand, the United States and Europe are interested in bringing down trade barriers in services and manufacturing. The continuing talks have served as a lightning rod for protesters, who claim that the World Trade Organization (WTO) serves the interests of multinational corporations, promotes trade over preserving the environment, and treats poor nations unfairly.6

The World Trade Organization replaces the old General Agreement on Tariffs and Trade (GATT), which was created in 1948. The GATT contained extensive loopholes that enabled countries to evade agreements to reduce trade barriers. Today, all WTO members must fully comply with all agreements under the Uruguay Round. The WTO also has an effective dispute settlement procedure with strict time limits to resolve disputes.

The WTO has emerged as the world’s most powerful institution for reducing trade barriers and opening markets. The advantage of WTO membership is that member countries lower trade barriers among themselves. Countries that don’t belong must negotiate trade agreements individually with all their trading partners. Only a few countries, such as North Korea, Turkmenistan, and Eritrea, are not members of the WTO.7

One of the biggest disputes before the WTO involves the United States and the European Union. The United States claims that Europe has given Airbus $15 billion in aid to develop airplanes. The European Union claims that the U.S. government has provided $23 billion in military research that has benefited Boeing’s commercial aircraft business. It also claimed that Washington State (the home of Boeing manufacturing) has given the company $3.2 billion in unfair tax breaks.8

WTO video: https://youtu.be/MrYMm-hq2-k

3.5 International Economic Communities

What are international economic communities?

Nations that frequently trade with each other may decide to formalize their relationship. The governments meet and work out agreements for a common economic policy. The result is an economic community or, in other cases, a bilateral trade agreement (an agreement between two countries to lower trade barriers). For example, two nations may agree upon a preferential tariff, which gives advantages to one nation (or several nations) over others. When members of the British Commonwealth (countries that are former British territories) trade with Great Britain, they pay lower tariffs than do other nations. For example, Canada and Australia are former British territories but are still members of the British Commonwealth. You will note that Queen Elizabeth still appears on Canadian currency and the Union Jack is still incorporated into the Australian flag. In other cases, nations may form free-trade associations. In a free-trade zone, few duties or rules restrict trade among the partners, but nations outside the zone must pay the tariffs set by the individual members.

North American Free Trade Agreement (NAFTA)

The North American Free Trade Agreement (NAFTA) created the world’s largest free-trade zone. The agreement includes Canada, the United States, and Mexico, with a combined population of 450 million and an economy of over $20.8 trillion.9

Canada entered a free-trade agreement with the United States in 1988. Thus, most of the new long-run opportunities opened for U.S. and Canadian business under NAFTA are in Mexico.

NAFTA video: https://youtu.be/LaMCK-Sec7Y

Before NAFTA, tariffs on Mexican exports to the United States averaged just four percent, and most goods entered the United States duty-free, so NAFTA’s primary impact was to open the Mexican market to U.S. companies. When the treaty went into effect, tariffs on about half the items traded across the Rio Grande disappeared. Since NAFTA came into effect, U.S.-Mexican trade has increased from $80 billion to $515 billion annually. The pact removed a web of Mexican licensing requirements, quotas, and tariffs that limited transactions on U.S. goods and services. For instance, the pact allows U.S. and Canadian financial-services companies to own subsidiaries in Mexico for the first time in 50 years.

The real test of NAFTA will be whether it can deliver rising prosperity on both sides of the Rio Grande. For Mexicans, NAFTA must provide rising wages, better benefits, and an expanding middle class with enough purchasing power to keep buying goods from the United States and Canada. That scenario seems to be working. At the Delphi Corp. auto parts plant in Ciudad Juárez, just across the border from El Paso, Texas, the assembly line is a cross section of working-class Mexicans. In the years since NAFTA lowered trade and investment barriers, Delphi has significantly expanded its presence in the country. Today it employs 70,000 Mexicans, who receive up to 70 million U.S.-made components to assemble every day. The wages are modest by U.S. standards—an assembly-line worker with two years’ experience earns about $2.30 an hour. But that’s triple Mexico’s minimum wage, and Delphi jobs are among the most coveted in Juárez. The United States recently notified the Canadian and Mexican governments that it intends to renegotiate aspects of the NAFTA agreement.10

The European Union

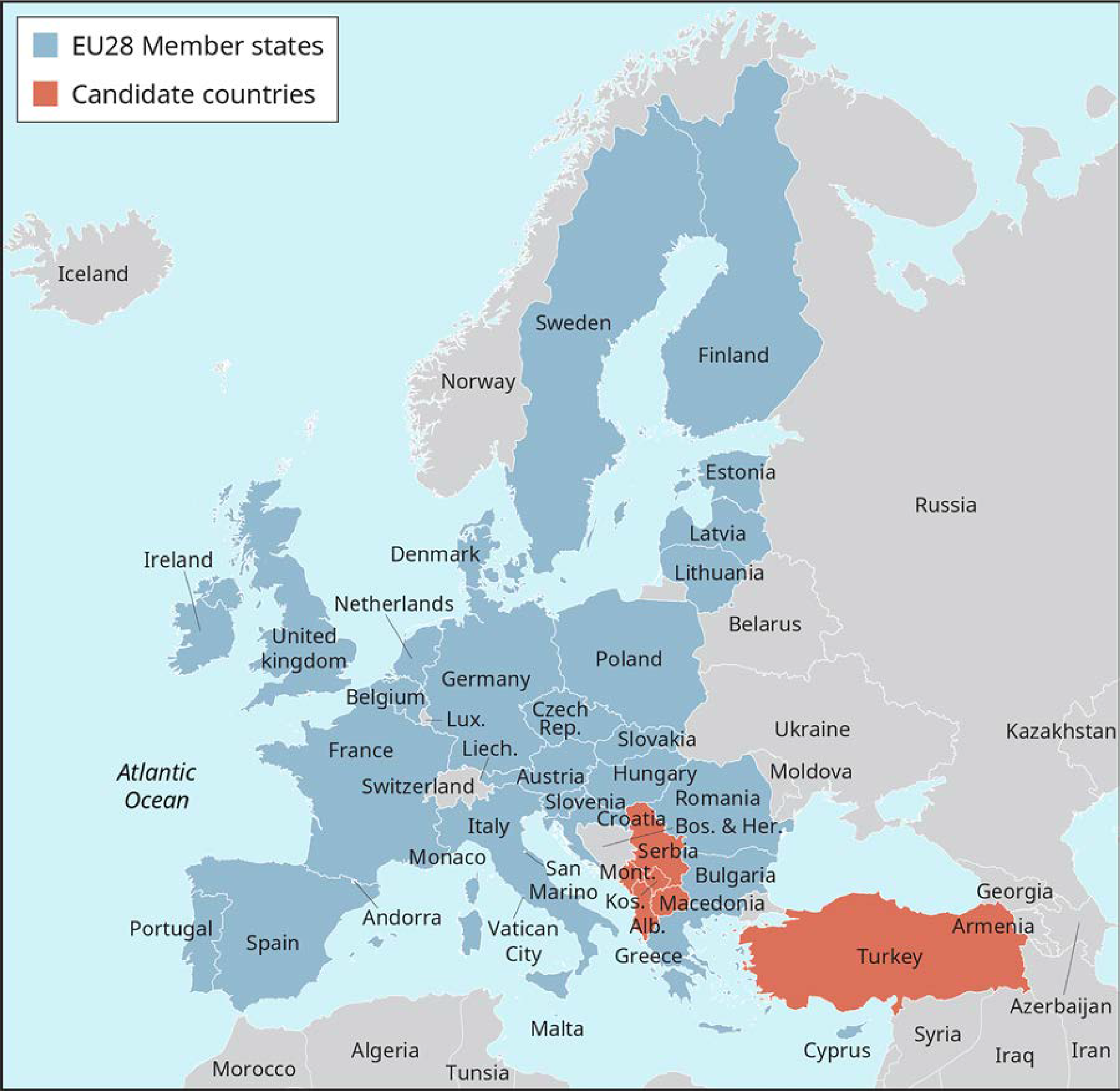

In 1993, the member countries of the European Community (EC) proposed to take the EC further toward economic, monetary, and political union. Although the heart of the treaty deals with developing a unified European Market it was also intended to increase integration among European Union (EU) members.

The EU has helped increase this integration by creating a borderless economy for the 28 European nations, shown on the map in Exhibit 3.6.11

European Union states have set up common institutions to which they delegate some of their sovereignty so that decisions on specific matters of joint interest can be made democratically at the European level. This pooling of sovereignty is also called European integration. In 2016, citizens of the United Kingdom voted to leave the European Union, a plan known as Brexit, which could take several years to occur.12

One of the principal objectives of the European Union is to promote economic progress of all member countries. The EU has stimulated economic progress by eliminating trade barriers, differences in tax laws, and differences in product standards, and by establishing a common currency. A new European Community Bank was created, along with a common currency called the euro. The European Union’s single market has created

2.5 million new jobs since it was founded and generated more than $1 trillion in new wealth.13 The opening of national EU markets has brought down the price of national telephone calls by 50 percent since 1998. Under pressure of competition, the prices of airfares in Europe have fallen significantly. The removal of national restrictions has enabled more than 15 million Europeans to go to another EU country to work or spend their retirement.

The European Union proposed a constitution that would centralize powers at the Union level and decrease the powers of individual member countries. It also would create a single voice in world affairs by creating a post of foreign minister. The constitution also gave the EU control over political asylum, immigration, guaranteed freedom of speech, and collective labour bargaining. In order to become law, each EU country had to ratify the constitution. The two most powerful countries in the EU, France and Germany, voted “no” in the summer of 2005. Citizens of both countries were afraid that the constitution would draw jobs away from Western Europe and to the Eastern EU countries. These new members of the EU have lower wage rates and fewer regulations. Voters were also worried that the constitution would result in free-market reforms along American or British lines over France and Germany’s traditional social protections. Concerns over immigration also sparked the referendum vote that is leading to the United Kingdom leaving the European Union.

3.6 Participating in the Global Marketplace

How do companies enter the global marketplace?

Companies decide to “go global” for a number of reasons. Perhaps the most urgent reason is to earn additional profits. If a firm has a unique product or technological advantage not available to other international competitors, this advantage should result in major business successes abroad. In other situations, management may have exclusive market information about foreign customers, marketplaces, or market situations. In this case, although exclusivity can provide an initial motivation for going global, managers must realize that competitors will eventually catch up. Finally, saturated domestic markets, excess capacity, and potential for cost savings can also be motivators to expand into international markets. A company can enter global trade in several ways, as this section describes.

Exporting

When a company decides to enter the global market, usually the least complicated and least risky alternative is exporting or selling domestically produced products to buyers in another country. A company, for example, can sell directly to foreign importers or buyers. Exporting is not limited to huge corporations such as General Motors or Apple. Indeed, small companies typically enter the global marketplace by exporting. China is the world’s largest exporter, followed by the United States.16 Many small businesses claim that they lack the money, time, or knowledge of foreign markets that exporting requires.

Entry modes: https://youtu.be/a2fqP5h0QuE

Licensing and Franchising

Another effective way for a firm to move into the global arena with relatively little risk is to sell a license to manufacture its product to a firm in a foreign country. Licensing is the legal process whereby a firm (the licensor) agrees to let another firm (the licensee) use a manufacturing process, trademark, patent, trade secret, or other proprietary knowledge. The licensee, in turn, agrees to pay the licensor a royalty or fee agreed on by both parties.

International licensing is a multibillion-dollar-a-year industry. Entertainment and character licensing, such as DVD movies and characters such as Batman, is the largest single category. Trademarks are the second-largest source of licensing revenue. Caterpillar licenses its brand for both shoes and clothing, which is very popular in Europe.

The licensor must make sure it can exercise sufficient control over the licensee’s activities to ensure proper quality, pricing, distribution, and so on. Licensing may also create a new competitor in the long run if the licensee decides to void the license agreement. International law is often ineffective in stopping such actions. Two common ways that a licensor can maintain effective control over its licensees are by shipping one or more critical components from the United States and by locally registering patents and trademarks in its own name.

Franchising is a form of licensing that has grown rapidly in recent years. Many Canadian franchisors operate thousands of outlets in foreign countries. More than half of the international franchises are for fast-food restaurants and business services. McDonald’s, however, decided to sell its Chinese stores to a group of outside investors for $1.8 billion, but retained 20 percent of the equity.17

Having a big-name franchise doesn’t always guarantee success or mean that the job will be easy. In China, Home Depot closed its stores after opening 12 to serve the large Chinese population. Had they done market research, they would have known that the majority of urban dwellers live in recently built apartments and that DIY (Do It Yourself) is viewed with disdain in Chinese society, where it is seen as a sign of poverty.18 When Subway opened its first sandwich shop in China, locals stood outside and watched for a few days. Patrons were so confused that the franchisee had to print signs explaining how to order. Customers didn’t believe the tuna salad was made from a fish because they couldn’t see the head or tail. And they didn’t like the idea of touching their food, so they would hold the sandwich vertically, peel off the paper wrap, and eat it like a banana. Most of all, the Chinese customers didn’t want sandwiches.

It’s not unusual for Western food chains to adapt their strategies when selling in China. McDonald’s, aware that the Chinese consume more chicken than beef, offered a spicy chicken burger. KFC got rid of coleslaw in favor of seasonal dishes such as shredded carrots or bamboo shoots.

Licensing video: https://youtu.be/TwdLXgIhXJA

Contract Manufacturing

In contract manufacturing, a foreign firm manufactures private-label goods under a domestic firm’s brand. Marketing may be handled by either the domestic company or the foreign manufacturer. Levi Strauss, for instance, entered into an agreement with the French fashion house of Cacharel to produce a new Levi’s line, Something New, for distribution in Germany.

The advantage of contract manufacturing is that it lets a company test the water in a foreign country. By allowing the foreign firm to produce a certain volume of products to specification and put the domestic firm’s brand name on the goods, the domestic firm can broaden its global marketing base without investing in overseas plants and equipment. After establishing a solid base, the domestic firm may switch to a joint venture or direct investment, explained below.

Joint Ventures

Joint ventures are similar to licensing agreements. In a joint venture, the domestic firm buys part of a foreign company or joins with a foreign company to create a new entity. A joint venture is a quick and relatively inexpensive way to enter the global market. It can also be very risky. Many joint ventures fail. Others fall victim to a takeover, in which one partner buys out the other.

Some countries require foreign companies to form local partnerships in order to establish a business in their country. China, for example, had this requirement in a number of industries until recently. Thus, a joint venture was the only way to enter the Chinese market. Joint ventures help reduce risks by sharing costs and technology. Often joint ventures will bring together different strengths from each member. In the General Motors-Suzuki joint venture in Canada, for example, both parties have contributed and gained. The alliance, CAMI Automotive, was formed to manufacture low-end cars for the U.S. market. The plant, which was run by Suzuki management, produces the Chevrolet Equinox and the Pontiac Torrent, as well as the new Suzuki SUV. Through CAMI, Suzuki has gained access to GM’s dealer network and an expanded market for parts and components. GM avoided the cost of developing low-end cars and obtained models it needed to revitalize the lower end of its product line and its average fuel economy rating. After the successful joint venture, General Motors gained full control of the operation in 2011. The CAMI factory may be one of the most productive plants in North America. There GM learned how Japanese automakers use work teams, run flexible assembly lines, and manage quality control.19

Direct Foreign Investment

Active ownership of a foreign company or overseas manufacturing or marketing facilities is called direct foreign investment. Direct investors have either a controlling interest or a large minority interest in the firm. Thus, they stand to receive the greatest potential reward but also face the greatest potential risk. A firm may make a direct foreign investment by acquiring an interest in an existing company or by building new facilities. It might do so because it has trouble transferring some resources to a foreign operation or obtaining that resource locally. One important resource is personnel, especially managers. If the local labour market is tight, the firm may buy an entire foreign firm and retain all its employees instead of paying higher salaries than competitors.

Sometimes firms make direct investments because they can find no suitable local partners. Also, direct investments avoid the communication problems and conflicts of interest that can arise with joint ventures. IBM, in the past, insisted on total ownership of its foreign investments because it did not want to share control with local partners.

General Motors has done very well by building a $4,400 (RMB 29,800) minivan in China that gets 43 miles per gallon in city driving. The Wuling Sunshine has a quarter of the horsepower of U.S. minivans, weak acceleration, and a top speed of 81 miles per hour. The seats are only a third of the thickness of seats in Western models, but look plush compared to similar Chinese cars. The minivans have made GM the largest automotive seller in China, and have made China a large profit center for GM.20

Walmart now has over 6,000 stores located outside the United States. In 2016, international sales were over $116 billion. About one-third of all new Walmart stores are opened in global markets.21

Not all of Walmart’s global investments have been successful. In Germany, Walmart bought the 21-store Wertkauf hypermarket chain and then 74 unprofitable and often decrepit Interspar stores. Problems in integrating and upgrading the stores resulted in at least $200 million in losses. Like all other German stores, Walmart stores were required by law to close at 8 p.m. on weekdays and 4 p.m. on Saturdays, and they could not open at all on Sundays. Costs were astronomical. As a result, Walmart left the German retail market.

Walmart has turned the corner on its international operations. It is pushing operational authority down to country managers in order to respond better to local cultures. Walmart enforces certain core principles such as everyday low prices, but country managers handle their own buying, logistics, building design, and other operational decisions.

Global firms change their strategies as local market conditions evolve. For example, major oil companies like Shell Oil and ExxonMobil had to react to dramatic changes in the price of oil due to technological advances such as more efficient automobiles, fracking, and horizontal drilling.

Foreign Direct Investment video: https://youtu.be/5DUyGWmcGVA

Countertrade

International trade does not always involve cash. Today, countertrade is a fast-growing way to conduct international business. In countertrade, part or all of the payment for goods or services is in the form of other goods or services. Countertrade is a form of barter (swapping goods for goods), an age-old practice whose origins have been traced back to cave dwellers. Recently, the Malaysian government bought 20 diesel-powered locomotives from China and paid for them with palm oil.

3.7 Threats and Opportunities in the Global Marketplace

What threats and opportunities exist in the global marketplace?

To be successful in a foreign market, companies must fully understand the foreign environment in which they plan to operate. Politics, cultural differences, and the economic environment can represent both opportunities and pitfalls in the global marketplace.

Political Considerations

We have already discussed how tariffs, exchange controls, and other governmental actions threaten foreign producers. The political structure of a country may also jeopardize a foreign producer’s success in international trade.

Intense nationalism, for example, can lead to difficulties. Nationalism is the sense of national consciousness that boosts the culture and interests of one country over those of all other countries. Strongly nationalistic countries, such as Iran and New Guinea, often discourage investment by foreign companies. In other, less radical forms of nationalism, the government may take actions to hinder foreign operations. France, for example, requires pop music stations to play at least 40 percent of their songs in French. This law was enacted because the French love American rock and roll. Without airtime, American music sales suffer. In another example of nationalism, U.S.-based PPG made an unsolicited bid to acquire Netherlands-based AzkoNobel NV. There was a chorus of opposition from Dutch politicians to the idea of a foreign takeover of AzkoNobel, the Dutch paint manufacturer. The government warned that it would move to defend AzkoNobel from a hostile takeover attempt. AzkoNobel played up the sentiment, tweeting about its rejection of the hostile takeover with the hashtag #DutchPride.22

In a hostile climate, a government may expropriate a foreign company’s assets, taking ownership and compensating the former owners. Even worse is confiscation, when the owner receives no compensation. This happened during rebellions in several African nations during the 1990s and 2000s.

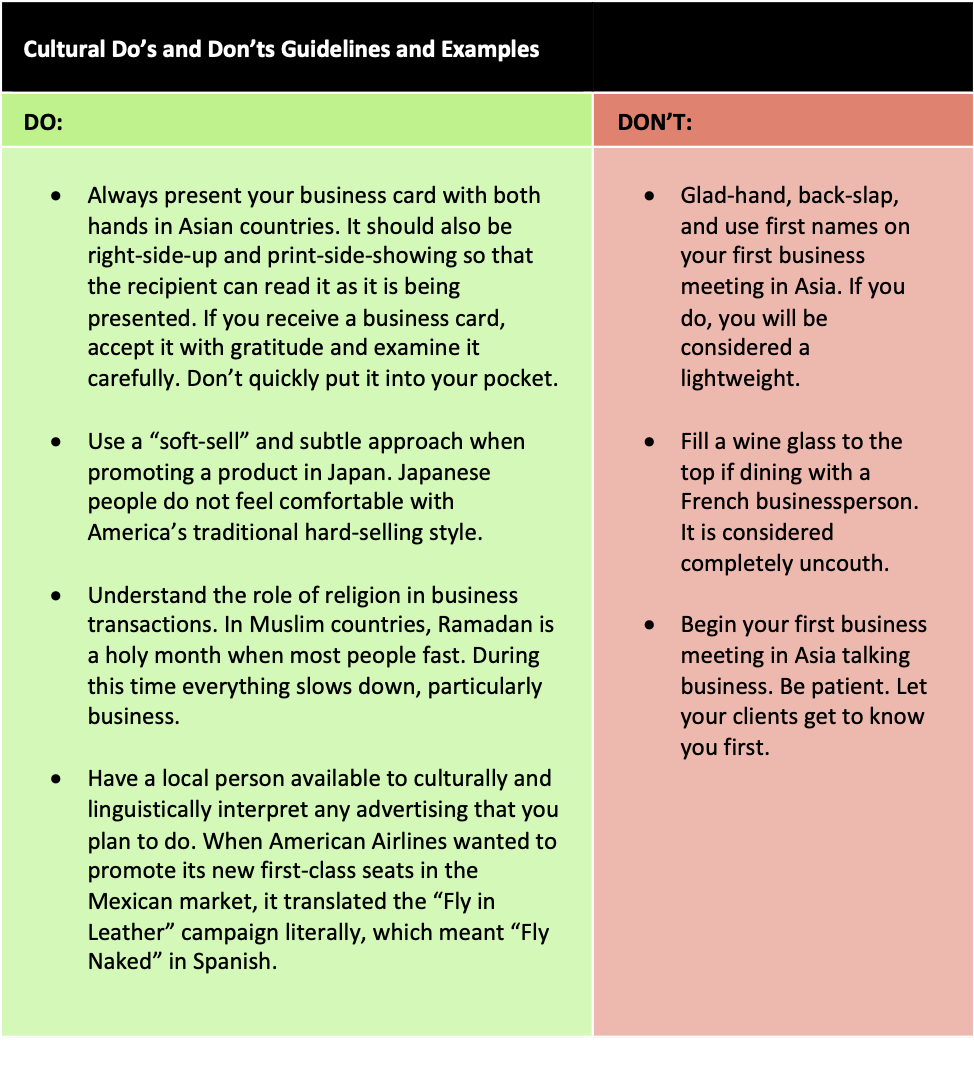

Cultural Differences

Central to any society is the common set of values shared by its citizens that determine what is socially acceptable. Culture underlies the family, educational system, religion, and social class system. The network of social organizations generates overlapping roles and status positions. These values and roles have a tremendous effect on people’s preferences and thus on marketers’ options. For example, China Walmart holds live fishing contests on the premises, and in South Korea the company hosts a food competition with variations on a popular Korean dish, kimchee.

Language is another important aspect of culture. Marketers must take care in selecting product names and translating slogans and promotional messages so as not to convey the wrong meaning. For example, Mitsubishi Motors had to rename its Pajero model in Spanish-speaking countries because the term refers to a sexual activity. Toyota Motor’s MR2 model dropped the 2 in France because the combination sounds like a French swear word. The literal translation of Coca-Cola in Chinese characters means “bite the wax tadpole.”

Each country has its own customs and traditions that determine business practices and influence negotiations with foreign customers. For example, attempting to do business in Western Europe during the first two weeks in August is virtually impossible. Businesses close, and everyone goes on vacation at the same time. In many countries, personal relationships are more important than financial considerations. For instance, skipping social engagements in Mexico may lead to lost sales. Negotiations in Japan often include long evenings of dining, drinking, and entertaining; only after a close personal relationship has been formed do business negotiations begin. Table 3.2 presents some cultural dos and don’ts.

Economic Environment

The level of economic development varies considerably, ranging from countries where everyday survival is a struggle, such as Sudan and Eritrea, to countries that are highly developed, such as Switzerland and Japan. In general, complex, sophisticated industries are found in developed countries, and more basic industries are found in less developed nations. Average family incomes are higher in the more developed countries than in the less developed markets. Larger incomes mean greater purchasing power and demand, not only for consumer goods and services but also for the machinery and workers required to produce consumer goods.

Business opportunities are usually better in countries that have an economic infrastructure in place. Infrastructure is the basic institutions and public facilities upon which an economy’s development depends. When we think about how our own economy works, we tend to take our infrastructure for granted. It includes the money and banking system that provide the major investment loans to our nation’s businesses; the educational system that turns out the incredible varieties of skills and basic research that actually run our nation’s production lines; the extensive transportation and communication systems—interstate highways, railroads, airports, canals, telephones, internet connectivity, postal systems, and television stations—that link almost every piece of our geography into one market; the energy system that powers our factories; and, of course, the market system itself, which brings our nation’s goods and services into our homes and businesses.

3.8 The Impact of Multinational Corporations

What are the advantages of multinational corporations?

Corporations that move resources, goods, services, and skills across national boundaries without regard to the country in which their headquarters are located are multinational corporations. Some are so rich and have so many employees that they resemble small countries. For example, the sales of both Exxon and Walmart are larger than the GDP of all but a few nations in the world. Multinational companies are heavily engaged in international trade. The successful ones take political and cultural differences into account.

Multinational Corporations video: https://youtu.be/Wo6hobrwPJQ

Many global brands sell much more outside the United States than at home. Coca-Cola, Philip Morris’s Marlboro brand, Pepsi, Kellogg, Pampers, Nescafe, and Gillette, are examples.

The Fortune 500 made over $1.5 trillion in profit in 2016. In slow-growing, developed economies like Europe and Japan a weaker dollar helps because it means cheaper products to sell into those markets, and profits earned in those markets translate into more dollars back home. Meanwhile, emerging markets in Asia, Latin America, and Eastern Europe are growing steadily. General Electric expects 60 percent of its revenue growth to come from emerging markets over the next decade. For Brown-Forman, the spirits company, a fifth of its sales growth for Jack Daniels, the Tennessee whiskey, is coming from developing markets like Mexico and Poland. IBM had rapid sales growth in emerging markets such as Russia, India, and Brazil.23 The largest multinational corporations in the world are shown in Table 3.3. Despite the success of American multinationals abroad, there is some indication that preference for U.S. brands may be slipping.

The Multinational Advantage

Large multinationals have several advantages over other companies. For instance, multinationals can often overcome trade problems. Taiwan and South Korea have long had an embargo against Japanese cars for political reasons and to help domestic automakers. Yet Honda USA, a Japanese-owned company based in the United States, sends Accords to Taiwan and Korea. In another example, when the environmentally conscious Green movement challenged the biotechnology research conducted by BASF, a major German chemical and drug manufacturer, BASF moved its cancer and immune-system research to Cambridge, Massachusetts.

Another advantage for multinationals is their ability to sidestep regulatory problems. U.S. drug maker SmithKline and Britain’s Beecham decided to merge in part so they could avoid licensing and regulatory hassles in their largest markets. The merged company can say it’s an insider in both Europe and the United States. “When we go to Brussels, we’re a member state [of the European Union],” one executive explains. “And when we go to Washington, we’re an American company.”

Multinationals can also shift production from one plant to another as market conditions change. When European demand for a certain solvent declined, Dow Chemical instructed its German plant to switch to manufacturing a chemical that had been imported from Louisiana and Texas. Computer models help Dow make decisions like these so it can run its plants more efficiently and keep costs down.

Multinationals can also tap new technology from around the world. In the United States, Xerox has introduced some 80 different office copiers that were designed and built by Fuji Xerox, its joint venture with a Japanese company. Versions of the super-concentrated detergent that Procter & Gamble first formulated in Japan, in response to a rival’s product, are now being sold under the Ariel brand name in Europe and under the Cheer and Tide labels in the United States. Also, consider Otis Elevator’s development of the Elevonic 411, an elevator that is programmed to send more cars to floors where demand is high. It was developed by six research centers in five countries. Otis’s group in Farmington, Connecticut, handled the systems integration, a Japanese group designed the special motor drives that make the elevators ride smoothly, a French group perfected the door systems, a German group handled the electronics, and a Spanish group took care of the small-geared components. Otis says the international effort saved more than $10 million in design costs and cut the process from four years to two.

Finally, multinationals can often save a lot in labour costs, even in highly unionized countries. For example, when Xerox started moving copier-rebuilding work to Mexico to take advantage of the lower wages, its union in Rochester, New York, objected because it saw that members’ jobs were at risk. Eventually, the union agreed to change work styles and to improve productivity to keep the jobs at home.

3.9 Trends in Global Competition

What are the trends in the global marketplace?

In this section, we will examine several underlying trends that will continue to propel the dramatic growth in world trade. These trends are market expansion, resource acquisition, and the emergence of China and India.

Market Expansion

The need for businesses to expand their markets is perhaps the most fundamental reason for the growth in world trade. The limited size of domestic markets often motivates managers to seek markets beyond their national frontiers. The economies of large-scale manufacturing demand big markets. Domestic markets, particularly in smaller countries like Denmark and the Netherlands, simply can’t generate enough demand. Nestlé was one of the first businesses to “go global” because its home country, Switzerland, is so small. Nestlé was shipping milk to 16 different countries as early as 1875. Today, hundreds of thousands of businesses are recognizing the potential rich rewards to be found in international markets.

Resource Acquisition

More and more companies are going to the global marketplace to acquire the resources they need to operate efficiently. These resources may be cheap or skilled labour, scarce raw materials, technology, or capital. Nike, for example, has manufacturing facilities in many Asian countries in order to use cheaper labour. Honda opened a design studio in southern California to put that “California flair” into the design of some of its vehicles. Large multinational banks, such as Bank of New York and Citigroup, have offices in Geneva, Switzerland. Geneva is the private banking center of Europe and attracts capital from around the globe.

The Emergence of China and India

China and India—two of the world’s economic powerhouses—are impacting businesses around the globe, in very different ways. The boom in China’s worldwide exports has left few sectors unscathed, whether it’s garlic growers in California, jeans makers in Mexico, or plastic-mold manufacturers in South Korea. India’s impact has altered how hundreds of service companies from Texas to Ireland compete for billions of dollars in contracts.

The causes and consequences of each nation’s growth are different. China’s exports have boomed largely thanks to foreign investment. Lured by low labour costs, big manufacturers have surged into China to expand their production base and push down prices globally. Now manufacturers of all sizes, making everything from windshield wipers to washing machines to clothing, are scrambling either to reduce costs at home or to outsource more of what they make in cheaper locales such as China and India.24

Indians are playing invaluable roles in the global innovation chain. Hewlett-Packard, Cisco Systems, and other tech giants now rely on their Indian teams to devise software platforms and multimedia features for next- generation devices. Google principal scientist Krishna Bharat set up the Google Bangalore lab complete with colorful furniture, exercise balls, and a Yamaha organ—like Google’s Mountain View, California, headquarters—to work on core search-engine technology. Indian engineering houses use 3-D computer simulations to tweak designs of everything from car engines and forklifts to aircraft wings for such clients as General Motors Corp. and Boeing Co. Not accounting for unforeseen circumstances, within five years India should vault over Germany as the world’s fourth-biggest economy. By mid-century, China should overtake the United States as number one. By then, China and India could account for half of global output.25

An accelerating trend is that technical and managerial skills in both China and India are becoming more important than cheap assembly labor. China will stay dominant in mass manufacturing and is one of the few nations building multibillion-dollar electronics and heavy industrial plants. India is a rising power in software, design, services, and precision industry.