Chapter 8: Financial Management and Securities Markets

Learning Objectives

After reading this chapter, you should be able to answer these questions:

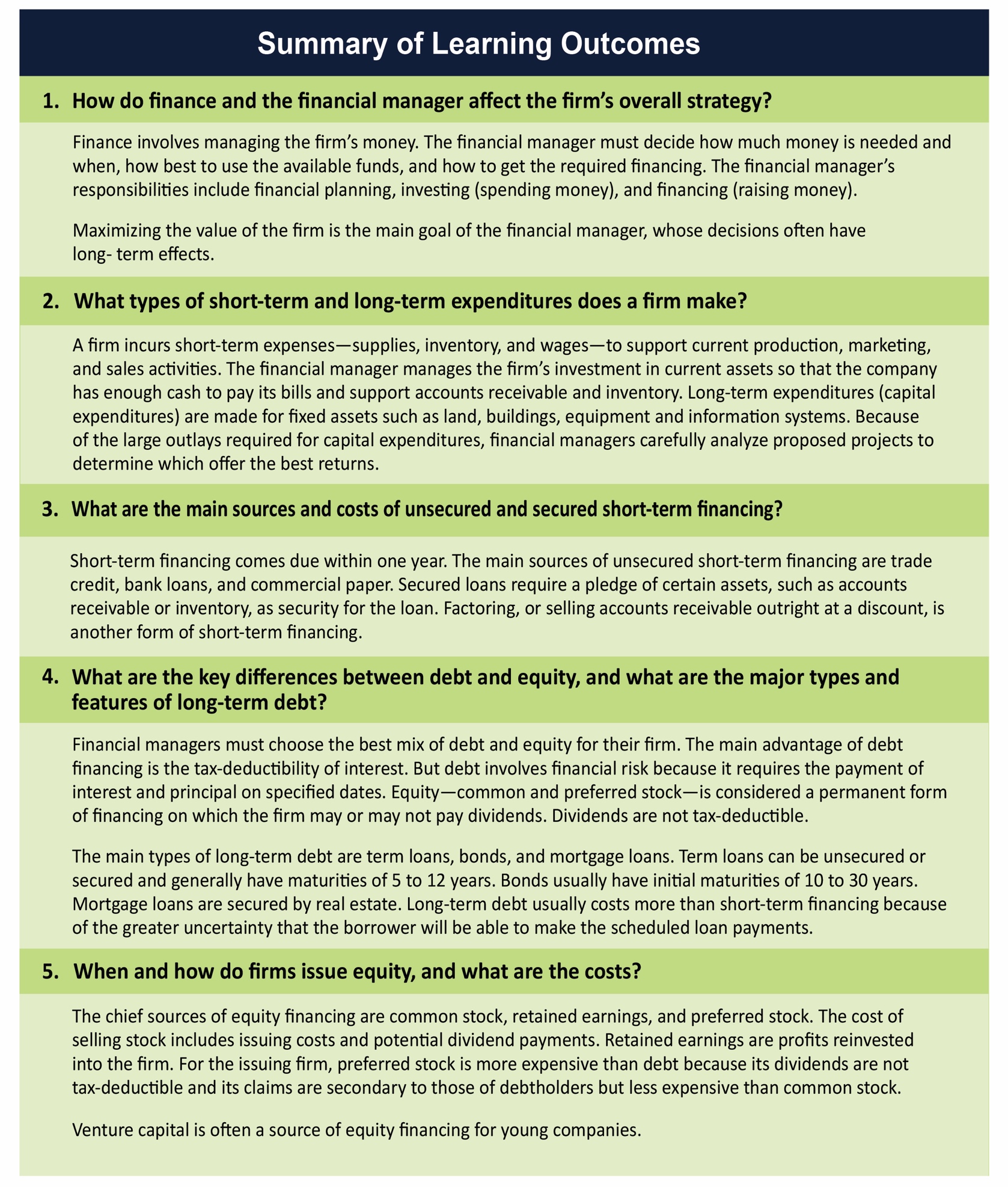

- How do finance and the financial manager affect a firm’s overall strategy?

- What types of short-term and long-term expenditures does a firm make?

- What are the main sources and costs of unsecured and secured short-term financing?

- What are the key differences between debt and equity, and what are the major types and features of long-term debt?

- When and how do firms issue equity, and what are the costs?

- How do securities markets help firms raise funding, and what securities trade in the capital markets?

- Where can investors buy and sell securities, and how are securities markets regulated?

In today’s fast-paced global economy, managing a firm’s finances is more complex than ever. For financial managers, a thorough command of traditional finance activities—financial planning, investing money, and raising funds—is only part of the job. Financial managers are more than number crunchers. As part of the top management team, chief financial officers (CFOs) need a broad understanding of their firm’s business and industry, as well as leadership ability and creativity. They must never lose sight of the primary goal of the financial manager: to maximize the value of the firm to its owners.

Financial management—spending and raising a firm’s money—is both a science and an art. The science part is analyzing numbers and flows of cash through the firm. The art is answering questions such as these: Is the firm using its financial resources in the best way? Aside from costs, why choose a particular form of financing? How risky is each option? Another important concern for both business managers and investors is understanding the basics of securities markets and the securities traded on them, which affect both corporate plans and investor pocketbooks.

This chapter focuses on the financial management of a firm and the securities markets in which firms raise funds. We’ll start with an overview of the role of finance and of the financial manager in the firm’s overall business strategy. Discussions of short and long-term uses of funds and investment decisions follow. Next, we’ll examine key sources of short and long-term financing. Then we’ll review the function, operation, and regulation of securities markets. Finally, we’ll look at key trends affecting financial management and securities markets.

8.1 The Role of Finance and the Financial Manager

How do finance and the financial manager affect the firm’s overall strategy?

Any company, whether it’s a small-town bakery or General Motors, needs money to operate. To make money, it must first spend money—on inventory and supplies, equipment and facilities, and employee wages and salaries. Therefore, finance is critical to the success of all companies. It may not be as visible as marketing or production, but management of a firm’s finances is just as much a key to the firm’s success.

Financial management—the art and science of managing a firm’s money so that it can meet its goals—is not just the responsibility of the finance department. All business decisions have financial consequences.

Managers in all departments must work closely with financial personnel. If you are a sales representative, for example, the company’s credit and collection policies will affect your ability to make sales. The head of the IT department will need to justify any requests for new computer systems or employee laptops.

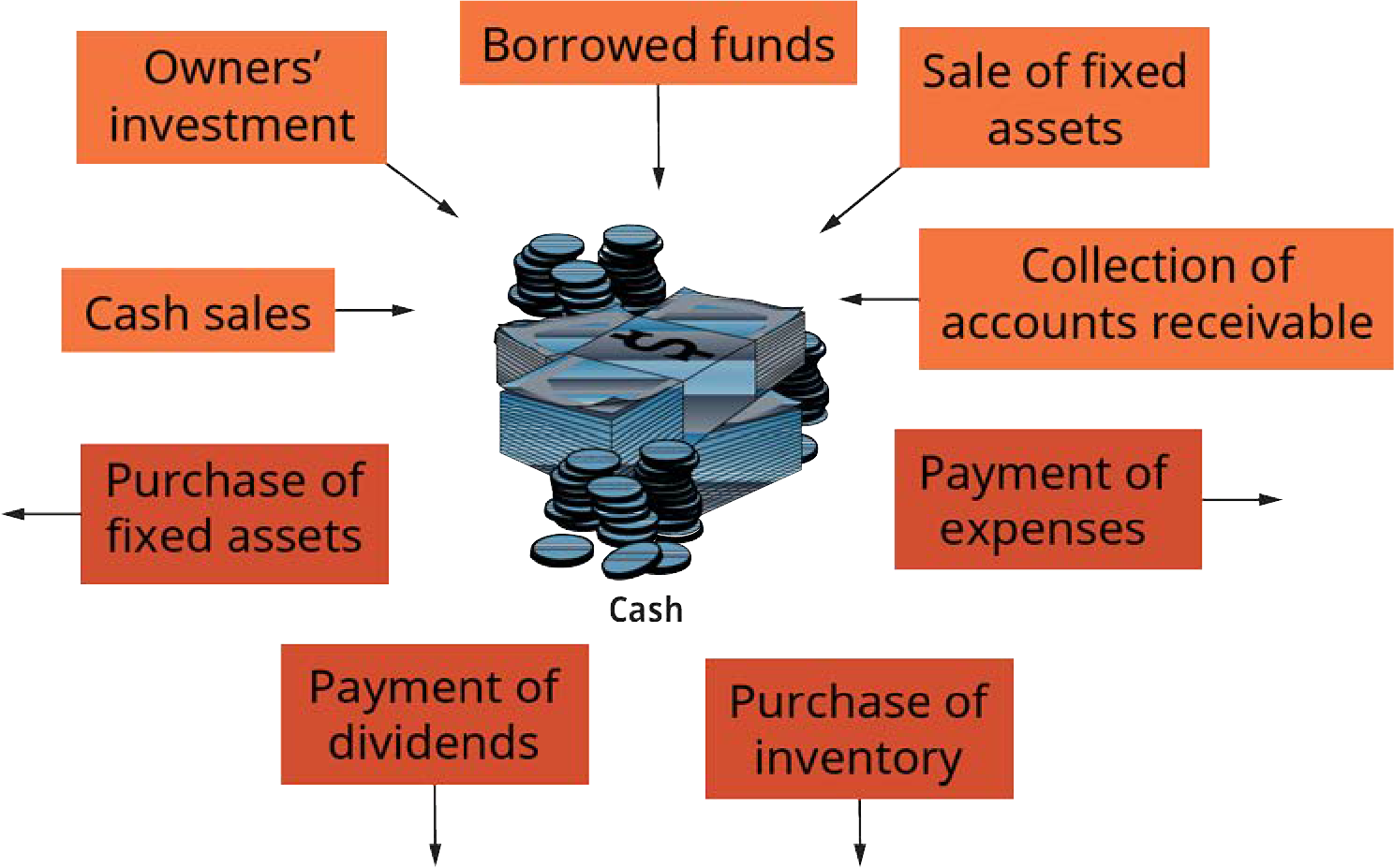

Revenues from sales of the firm’s products should be the chief source of funding. But money from sales doesn’t always come in when it’s needed to pay the bills. Financial managers must track how money is flowing into and out of the firm (see Exhibit 8.1). They work with the firm’s other department managers to determine how available funds will be used and how much money is needed. Then they choose the best sources to obtain the required funding.

For example, a financial manager will track day-to-day operational data such as cash collections and disbursements to ensure that the company has enough cash to meet its obligations. Over a longer time horizon, the manager will thoroughly study whether and when the company should open a new manufacturing facility. The manager will also suggest the most appropriate way to finance the project, raise the funds, and then monitor the project’s implementation and operation.

Financial management is closely related to accounting. In most firms, both areas are the responsibility of the vice president of finance or CFO. But the accountant’s main function is to collect and present financial data. Financial managers use financial statements and other information prepared by accountants to make financial decisions. Financial managers focus on cash flows, the inflows and outflows of cash. They plan and monitor the firm’s cash flows to ensure that cash is available when needed.

The Financial Manager’s Responsibilities and Activities

Financial managers have a complex and challenging job. They analyze financial data prepared by accountants, monitor the firm’s financial status, and prepare and implement financial plans. One day they may be developing a better way to automate cash collections, and the next they may be analyzing a proposed acquisition. The key activities of the financial manager are:

- Financial planning: Preparing the financial plan, which projects revenues, expenditures, and financing needs over a given period.

- Investment (spending money): Investing the firm’s funds in projects and securities that provide high returns in relation to their risks.

- Financing (raising money): Obtaining funding for the firm’s operations and investments and seeking the best balance between debt (borrowed funds) and equity (funds raised through the sale of ownership in the business).

The Goal of the Financial Manager

How can financial managers make wise planning, investment, and financing decisions? The main goal of the financial manager is to maximize the value of the firm to its owners. The value of a publicly owned corporation is measured by the share price of its stock. A private company’s value is the price at which it could be sold.

To maximize the firm’s value, the financial manager has to consider both short and long-term consequences of the firm’s actions. Maximizing profits is one approach, but it should not be the only one. Such an approach favours making short-term gains over achieving long-term goals. What if a firm in a highly technical and competitive industry did no research and development? In the short run, profits would be high because research and development is very expensive. But in the long run, the firm might lose its ability to compete because of its lack of new products.

This is true regardless of a company’s size or point in its life cycle. At Corning, a company founded more than 160 years ago, management believes in taking the long-term view and not managing for quarterly earnings to satisfy Wall Street’s expectations. The company, once known to consumers mostly for kitchen products such as Corelle dinnerware and Pyrex heat-resistant glass cookware, is today a technology company that manufactures specialized glass and ceramic products. It is a leading supplier of Gorilla Glass, a special type of glass used for the screens of mobile devices, including the iPhone, the iPad, and devices powered by Google’s Android operating system. The company was also the inventor of optical fiber and cable for the telecommunications industry. These product lines require large investments during their long research and development (R&D) cycles and for plant and equipment once they go into production.1

This can be risky in the short term but staying the course can pay off. In fact, Corning recently announced plans to develop a separate company division for Gorilla Glass, which now has more than 20 percent of the phone market—with over 200 million devices sold. In addition, its fiber-optic cable business is back in vogue and thriving as cable service providers such as Verizon have doubled down on upgrading the fiber-optic network across the United States. As of 2017, Corning’s commitment to repurposing some of its technologies and developing new products has helped the company’s bottom line, increasing revenues in a recent quarter by more than 16 percent.2

As the Corning situation demonstrates, financial managers constantly strive for a balance between the opportunity for profit and the potential for loss. In finance, the opportunity for profit is termed return; the potential for loss, or the chance that an investment will not achieve the expected level of return, is risk. A basic principle in finance is that the higher the risk, the greater the return that is required. This widely accepted concept is called the risk-return trade-off. Financial managers consider many risk and return factors when making investment and financing decisions. Among them are changing patterns of market demand, interest rates, general economic conditions, market conditions, and social issues (such as environmental effects and equal employment opportunity policies).

8.2 How Organizations Use Funds

What types of short-term and long-term expenditures does a firm make?

To grow and prosper, a firm must keep investing money in its operations. The financial manager decides how best to use the firm’s money. Short-term expenses support the firm’s day-to-day activities. For instance, athletic-apparel maker, Nike, regularly spends money to buy raw materials such as leather and fabric and to pay employee salaries. Long-term expenses are typically for fixed assets. For Nike, these would include outlays to build a new factory, buy automated manufacturing equipment, or acquire a small manufacturer of sports apparel.

Short-Term Expenses

Short-term expenses, often called operating expenses, are outlays used to support current production and selling activities. They typically result in current assets, which include cash and any other assets (accounts receivable and inventory) that can be converted to cash within a year. The financial manager’s goal is to manage current assets, so the firm has enough cash to pay its bills and to support its accounts receivable and inventory.

Cash Management: Assuring Liquidity

Cash is the lifeblood of business. Without it, a firm could not operate. An important duty of the financial manager is cash management or making sure that enough cash is on hand to pay bills as they come due and to meet unexpected expenses.

Businesses estimate their cash requirements for a specific period. Many companies keep a minimum cash balance to cover unexpected expenses or changes in projected cash flows. The financial manager arranges loans to cover any shortfalls. If the size and timing of cash inflows closely match the size and timing of cash outflows, the company needs to keep only a small amount of cash on hand. A company whose sales and receipts are fairly predictable and regular throughout the year needs less cash than a company with a seasonal pattern of sales and receipts. A toy company, for instance, whose sales are concentrated in the fall, spends a great deal of cash during the spring and summer to build inventory. It has excess cash during the winter and early spring, when it collects on sales from its peak selling season.

Because cash held in checking accounts earns little, if any, interest, the financial manager tries to keep cash balances low and to invest the surplus cash. Surpluses are invested temporarily in marketable securities, short-term investments that are easily converted into cash. The financial manager looks for low-risk investments that offer high returns. Three of the most popular marketable securities are Treasury bills, certificates of deposit, and commercial paper. (Commercial paper is unsecured short-term debt—an IOU(I owe you)—issued by a financially strong corporation.) Today’s financial managers have new tools to help them find the best short-term investments, such as online trading platforms that save time and provide access to more types of investments. These have been especially useful for smaller companies who don’t have large finance staffs.

Companies with overseas operations face even greater cash management challenges. Developing the systems for international cash management may sound simple in theory, but in practice it’s extremely complex. In addition to dealing with multiple foreign currencies, treasurers must understand and follow banking practices and regulatory and tax requirements in each country. Regulations may impede their ability to move funds freely across borders. Also, issuing a standard set of procedures for every office may not work because local business practices differ from country to country. In addition, local managers may resist the shift to a centralized structure because they don’t want to give up control of cash generated by their units. Corporate financial managers must be sensitive to and aware of local customs and adapt the centralization strategy accordingly.

In addition to seeking the right balance between cash and marketable securities, the financial manager tries to shorten the time between the purchase of inventory or services (cash outflows) and the collection of cash from sales (cash inflows). The three key strategies are to collect money owed to the firm (accounts receivable) as quickly as possible, to pay money owed to others (accounts payable) as late as possible without damaging the firm’s credit reputation, and to minimize the funds tied up in inventory.

Managing Accounts Receivable

Accounts receivable represent sales for which the firm has not yet been paid. Because the product has been sold but cash has not yet been received, an account receivable amounts to a use of funds. For the average manufacturing firm, accounts receivable represents about 15 to 20 percent of total assets.

The financial manager’s goal is to collect money owed to the firm as quickly as possible, while offering customers credit terms attractive enough to increase sales. Accounts receivable management involves setting credit policies, guidelines on offering credit, credit terms, and specific repayment conditions, including how long customers have to pay their bills and whether a cash discount is given for quicker payment. Another aspect of accounts receivable management is deciding on collection policies, the procedures for collecting overdue accounts.

Setting up credit and collection policies is a balancing act for financial managers. On the one hand, easier credit policies or generous credit terms (a longer repayment period or larger cash discount) result in increased sales. On the other hand, the firm has to finance more accounts receivable. The risk of uncollectible accounts receivable also rises. Businesses consider the impact on sales, timing of cash flow, experience with bad debt, customer profiles, and industry standards when developing their credit and collection policies.

Companies that want to speed up collections actively manage their accounts receivable, rather than passively letting customers pay when they want to. According to recent statistics, more than 90 percent of businesses experience late payments from customers, and some companies write off a percentage of their bad debt, which can be expensive.3

Technology plays a big role in helping companies improve their credit and collections performance. For example, many companies use some type of automated decision-making, whether that comes in the form of an Enterprise Resource Planning system or a combination of software programs and supplemental modules that help companies make informed decisions when it comes to credit and collection processes.4

Other companies choose to outsource financial and accounting business processes to specialists rather than develop their own systems. The availability of cutting-edge technology and specialized electronic platforms that would be difficult and expensive to develop in-house is winning over firms of all sizes. Giving up control of finance to a third party has not been easy for CFOs. The risks are high when financial and other sensitive corporate data are transferred to an outside computer system: data could be compromised or lost, or rivals could steal corporate data. It’s also harder to monitor an outside provider than your own employees. One outsourcing area that has attracted many clients is international trade, which has regulations that differ from country to country and requires huge amounts of documentation. With specialized IT systems, providers can track not only the physical location of goods, but also all the paperwork associated with shipments. Processing costs for goods purchased overseas are about twice those of domestic goods, so more efficient systems pay off.5

Inventory

Another use of funds is to buy inventory needed by the firm. In a typical manufacturing firm, inventory is nearly 20 percent of total assets. The cost of inventory includes not only its purchase price, but also ordering, handling, storage, interest, and insurance costs.

Production, marketing, and finance managers usually have differing views about inventory. Production managers want lots of raw materials on hand to avoid production delays. Marketing managers want lots of finished goods on hand, so customer orders can be filled quickly. But financial managers want the least inventory possible without harming production efficiency or sales. Financial managers must work closely with production and marketing to balance these conflicting goals. Techniques for reducing the investment in inventory are inventory management, the just-in-time system, and materials requirement planning.

For retail firms, inventory management is a critical area for financial managers, who closely monitor inventory turnover ratios. This ratio shows how quickly inventory moves through the firm and is turned into sales. If the inventory number is too high, it will typically affect the amount of working capital a company has on hand, forcing the company to borrow money to cover the excess inventory. If the turnover ratio number is too high, it means the company does not have enough inventory of products on hand to satisfy customer needs, which means they could take their business elsewhere.6

Long-Term Expenditures

A firm also invests funds in physical assets such as land, buildings, machinery, equipment, and information systems. These are called capital expenditures. Unlike operating expenses, which produce benefits within a year, the benefits from capital expenditures extend beyond one year. For instance, a printer’s purchase of a new printing press with a usable life of seven years is a capital expenditure and appears as a fixed asset on the firm’s balance sheet. Paper, ink, and other supplies, however, are expenses. Mergers and acquisitions are also considered capital expenditures.

Firms make capital expenditures for many reasons. The most common are to expand, to replace or renew fixed assets, and to develop new products. Most manufacturing firms have a big investment in long-term assets. Boeing Company, for instance, puts billions of dollars a year into airplane-manufacturing facilities. Because capital expenditures tend to be costly and have a major effect on the firm’s future, the financial manager uses a process called capital budgeting to analyze long-term projects and select those that offer the best returns while maximizing the firm’s value. Decisions involving new products, or the acquisition of another business are especially important. Managers look at project costs and forecast the future benefits the project will bring to calculate the firm’s estimated return on the investment.

8.3 Obtaining Short-Term Financing

What are the main sources and costs of unsecured and secured short-term financing?

How do firms raise the funding they need?

- borrow money (debt)

- sell ownership shares (equity)

- use retain earnings (profits)

The financial manager must assess all these sources and choose the one most likely to help maximize the firm’s value.Like expenses, borrowed funds can be divided into short and long-term loans. A short-term loan comes due within one year; a long-term loan has a maturity greater than one year. Short-term financing is shown as a current liability on the balance sheet and is used to finance current assets and support operations. Short-term loans can be unsecured or secured.

Short-term Financing video: https://youtu.be/GlabOH78TMM

Unsecured Short-Term Loans

Unsecured loans are made based on the firm’s creditworthiness and the lender’s previous experience with the firm. An unsecured borrower does not have to pledge specific assets as security. The three main types of unsecured short-term loans are trade credit, bank loans, and commercial paper.

Trade Credit: Accounts Payable

When Goodyear sells tires to General Motors, GM does not have to pay cash on delivery. Instead, Goodyear regularly bills GM for its tire purchases, and GM pays at a later date. This is an example of trade credit: the seller extends credit to the buyer between the time the buyer receives the goods or services and when they pay for them. Trade credit is a major source of short-term business financing. The buyer enters the credit on its books as an account payable. In effect, the credit is a short-term loan from the seller to the buyer of the goods and services. Until GM pays Goodyear, Goodyear has an account receivable from GM, and GM has an account payable to Goodyear.

Bank Loans

Unsecured bank loans are another source of short-term business financing. Companies often use these loans to finance seasonal (cyclical) businesses. Unsecured bank loans include lines of credit and revolving credit agreements. A line of credit specifies the maximum amount of unsecured short-term borrowing the bank will allow the firm over a given period of time, typically one year. The firm either pays a fee or keeps a certain percentage of the loan amount (generally 10 to 20 percent) in a checking account at the bank. Another bank loan, the revolving credit agreement, is basically a guaranteed line of credit that carries an extra fee in addition to interest. Revolving credit agreements are often arranged for a period of two to five years.

Commercial Paper

As noted earlier, commercial paper is an unsecured short-term debt—an IOU—issued by a financially strong corporation. Thus, it is both a short-term investment and a financing option for major corporations.

Corporations issue commercial paper in multiples of $100,000 for periods ranging from 3 to 270 days. Many big companies use commercial paper instead of short-term bank loans because the interest rate on commercial paper is usually 1 to 3 percent below bank rates.

Secured Short-Term Loans

Secured loans require the borrower to pledge specific assets as collateral, or security. The secured lender can legally take the collateral if the borrower doesn’t repay the loan. Commercial banks and commercial finance companies are the main sources of secured short-term loans to business. Borrowers whose credit is not strong enough to qualify for unsecured loans use these loans. Typically, the collateral for secured short-term loans is accounts receivable or inventory. Because accounts receivable are normally quite liquid (easily converted to cash), they are an attractive form of collateral. The appeal of inventory—raw materials or finished goods—as collateral depends on how easily it can be sold at a fair price.

Another form of short-term financing using accounts receivable is factoring. A firm sells its accounts receivable outright to a factor, a financial institution (often a commercial bank or commercial finance company) that buys accounts receivable at a discount. Factoring is widely used in the clothing, furniture, and appliance industries. Factoring is more expensive than a bank loan because the factor buys the receivables at a discount from their actual value.

8.4 Raising Long-Term Financing

What are the key differences between debt and equity, and what are the major types and features of long-term debt?

A basic principle of finance is to match the term of the financing to the period over which benefits are expected to be received from the associated outlay. Short-term items should be financed with short-term funds, and long-term items should be financed with long-term funds. Long-term financing sources include both debt (borrowing) and equity (ownership). Equity financing comes either from selling new ownership interests or from retaining earnings. Financial managers try to select the mix of long-term debt and equity that results in the best balance between cost and risk.

Debt versus Equity Financing

Say that the Boeing Company plans to spend $2 billion over the next four years to build and equip new factories to make jet aircraft. Boeing’s top management will assess the pros and cons of both debt and equity and then consider several possible sources of the desired form of long-term financing.

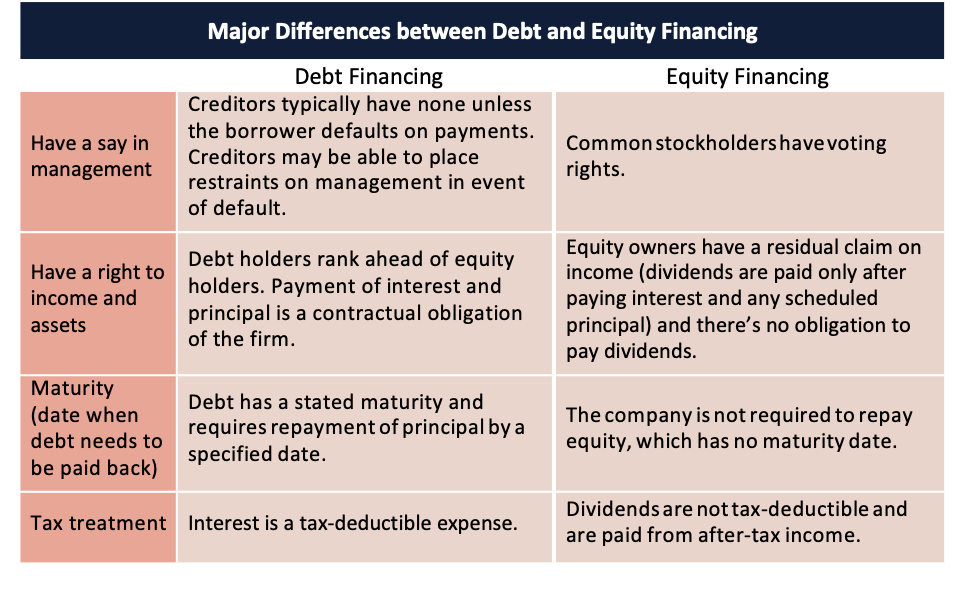

The major advantage of debt financing is the deductibility of interest expense for income tax purposes, which lowers its overall cost. In addition, there is no loss of ownership. The major drawback is financial risk: the chance that the firm will be unable to make scheduled interest and principal payments. The lender can force a borrower that fails to make scheduled debt payments into bankruptcy. Most loan agreements have restrictions to ensure that the borrower operates efficiently.

Equity, on the other hand, is a form of permanent financing that places few restrictions on the firm. The firm is not required to pay dividends or repay the investment. However, equity financing gives common stockholders voting rights that provide them with a voice in management. Equity is more costly than debt. Unlike the interest on debt, dividends to owners are not tax-deductible expenses. Table 8.1 summarizes the major differences between debt and equity financing.

Debt Financing

Long-term debt is used to finance long-term (capital) expenditures. The initial maturities of long-term debt typically range between 5 and 20 years. Three important forms of long-term debt are term loans, bonds, and mortgage loans.

A term loan is a business loan with a maturity of more than one year. Term loans generally have maturities of 5 to 12 years and can be unsecured or secured. They are available from commercial banks, insurance companies, pension funds, commercial finance companies, and manufacturers’ financing subsidiaries. A contract between the borrower and the lender spells out the amount and maturity of the loan, the interest rate, payment dates, the purpose of the loan, and other provisions such as operating and financial restrictions on the borrower to control the risk of default. The payments include both interest and principal, so the loan balance declines over time. Borrowers try to arrange a repayment schedule that matches the forecast cash flow from the project being financed.

Bonds are long-term debt obligations (liabilities) of corporations and governments. A bond certificate is issued as proof of the obligation. The issuer of a bond must pay the buyer a fixed amount of money—called interest, stated as the coupon rate—on a regular schedule, typically every six months. The issuer must also pay the bondholder the amount borrowed—called the principal, or par value—at the bond’s maturity date (due date). Bonds are usually issued in units of $1,000—for instance, $1,000, $5,000, or $10,000—and have initial maturities of 10 to 30 years. They may be secured or unsecured, include special provisions for early retirement, or be convertible to common stock.

Bonds video: https://youtu.be/IuyejHOGCro

A mortgage loan is a long-term loan made against real estate as collateral. The lender takes a mortgage on the property, which lets the lender seize the property, sell it, and use the proceeds to pay off the loan if the borrower fails to make the scheduled payments. Long-term mortgage loans are often used to finance office buildings, factories, and warehouses. Life insurance companies are an important source of these loans. They make billions of dollars’ worth of mortgage loans to businesses each year.

8.5 Equity Financing

When and how do firms issue equity, and what are the costs?

Equity refers to the owners’ investment in the business. In corporations, the preferred and common stockholders are the owners. A firm obtains equity financing by selling new ownership shares (external financing), by retaining earnings (internal financing), or for small and growing, typically high-tech, companies, through venture capital (external financing).

Selling New Issues of Common Stock

Common stock is a security that represents an ownership interest in a corporation. A company’s first sale of stock to the public is called an initial public offering (IPO). An IPO often enables existing stockholders, usually employees, family, and friends who bought the stock privately, to earn big profits on their investment. (Companies that are already public can issue and sell additional shares of common stock to raise equity funds.)

Stocks video: https://youtu.be/oVVt6P2q-6c

But going public has some drawbacks. For one thing, there is no guarantee an IPO will sell. It is also expensive. Big fees must be paid to investment bankers, brokers, attorneys, accountants, and printers. Once the company is public, it is closely watched by regulators, stockholders, and securities analysts. The firm must reveal such information as operating and financial data, product details, financing plans, and operating strategies. Providing this information is often costly.

Going public is the dream of many small company founders and early investors, who hope to recoup their investments and become instant millionaires. Google went public in 2004 at $85 a share and soared to $475 in early 2006 before settling back to trade in the high-300 range in August 2006. More than a decade later, in October 2017, Google continues to be a successful IPO, trading at more than $990 per share.

In recent years, the number of IPOs has dropped sharply, as start-ups think long and hard about going public, despite the promise of millions of dollars for investors and entrepreneurs. For example, in 2017, Blue Apron, a meal-kit delivery service, went public with an opening stock price of $10 per share. Several months later, the share price dropped more than 40 percent. Some analysts believe that Amazon’s possible entry into the meal-kit delivery sector has hurt Blue Apron’s value, as well as the company’s high marketing costs to attract and retain monthly subscribers.7

Some companies choose to remain private. Cargill, SC Johnson, Mars, Publix Super Markets, and Bloomberg are among the largest U.S. private companies.

Dividends and Retained Earnings

Dividends are payments to stockholders from a corporation’s profits. Dividends can be paid in cash or in stock. Stock dividends are payments in the form of more stock. Stock dividends may replace or supplement cash dividends. After a stock dividend has been paid, more shares have a claim on the same company, so the value of each share often declines. A company does not have to pay dividends to stockholders. But if investors buy the stock expecting to get dividends and the firm does not pay them, the investors may sell their stocks.

At their quarterly meetings, the company’s board of directors (typically with the advice of its CFO) decides how much of the profits to distribute as dividends and how much to reinvest. A firm’s basic approach to paying dividends can greatly affect its share price. A stable history of dividend payments indicates good financial health. For example, cable giant Comcast has increased its dividend more than 20 percent over the past five years, giving shareholders a healthy return on their investment.8

If a firm that has been making regular dividend payments cuts or skips a dividend, investors start thinking it has serious financial problems. The increased uncertainty often results in lower stock prices. Thus, most firms set dividends at a level they can keep paying. They start with a relatively low dividend payout ratio so that they can maintain a steady or slightly increasing dividend over time.

Retained earnings, profits that have been reinvested in the firm, have a big advantage over other sources of equity capital: They do not incur underwriting costs. Financial managers strive to balance dividends and retained earnings to maximize the value of the firm. Often the balance reflects the nature of the firm and its industry. Well-established and stable firms and those that expect only modest growth, such as public utilities, financial services companies, and large industrial corporations, typically pay out much of their earnings in dividends. For example, in the 2016 fiscal year, ExxonMobil paid dividends of $3.08 per share, Altria Group paid $2.64 per share, Apple paid $2.23 per share, and Costco paid $2.00 per share.

Most high-growth companies, such as those in technology-related fields, finance much of their growth through retained earnings and pay little or no dividends to stockholders. As they mature, many decide to begin paying dividends, as Apple decided to do in 2012, after 17 years of paying no annual dividends to shareholders.9

Preferred Stock

Another form of equity is preferred stock. Unlike common stock, preferred stock usually has a dividend amount that is set at the time the stock is issued. These dividends must be paid before the company can pay any dividends to common stockholders. Also, if the firm goes bankrupt and sells its assets, preferred stockholders get their money back before common stockholders do.

Like debt, preferred stock increases the firm’s financial risk because it obligates the firm to make a fixed payment. But preferred stock is more flexible. The firm can miss a dividend payment without suffering the serious results of failing to pay back a debt.

Preferred stock is more expensive than debt financing because preferred dividends are not tax-deductible. Also, because the claims of preferred stockholders on income and assets are second to those of debtholders, preferred stockholders require higher returns to compensate for the greater risk.

8.6 Securities Markets

How do securities markets help firms raise funding, and what securities trade in the capital markets?

Stocks, bonds, and other securities trade in securities markets. These markets streamline the purchase and sales activities of investors by allowing transactions to be made quickly and at a fair price. Securities are investment certificates that represent either equity (ownership in the issuing organization) or debt (a loan to the issuer). Corporations and governments raise capital to finance operations and expansion by selling securities to investors, who in turn take on a certain amount of risk with the hope of receiving a profit from their investment.

Securities markets are busy places. On an average day, individual and institutional investors trade billions of shares of stock in more than 10,000 companies through securities markets. Individual investors invest their own money to achieve their personal financial goals. Institutional investors are investment professionals who are paid to manage other people’s money. Most of these professional money managers work for financial institutions, such as banks, mutual funds, insurance companies, and pension funds. Institutional investors control very large sums of money, often buying stock in 10,000-share blocks. They aim to meet the investment goals of their clients. Institutional investors are a major force in the securities markets, accounting for about half of the dollar volume of equities traded.

Types of Markets

Securities markets can be divided into primary and secondary markets. The primary market is where new securities are sold to the public, usually with the help of investment bankers. In the primary market, the issuer of the security gets the proceeds from the transaction. A security is sold in the primary market just once—when the corporation or government first issues it. The Blue Apron IPO is an example of a primary market offering.

Later transactions take place in the secondary market, where old (already issued) securities are bought and sold, or traded, among investors. The issuers generally are not involved in these transactions. The vast majority of securities transactions take place in secondary markets, which include broker markets, dealer markets, the over-the-counter market, and the commodities exchanges. You’ll see tombstones, announcements of both primary and secondary stock and bond offerings, in the Wall Street Journal and other newspapers.

The Role of Investment Bankers and Stockbrokers

Two types of investment specialists play key roles in the functioning of the securities markets. Investment bankers help companies raise long-term financing. These firms act as intermediaries, buying securities from corporations and governments and reselling them to the public. This process, called underwriting, is the main activity of the investment banker, which acquires the security for an agreed-upon price and hopes to be able to resell it at a higher price to make a profit. Investment bankers advise clients on the pricing and structure of new securities offerings, as well as on mergers, acquisitions, and other types of financing. Well-known investment banking firms include Goldman Sachs, Morgan Stanley and JP Morgan. In Canada some well-known institutions include BMO Capital Markets, TD securities and Cannacord Genuity.

A stockbroker is a person who is licensed to buy and sell securities on behalf of clients. Also called account executives, these investment professionals work for brokerage firms and execute the orders customers place for stocks, bonds, mutual funds, and other securities. Investors are wise to seek a broker who understands their investment goals and can help them pursue their objectives.

Brokerage firms are paid commissions for executing clients’ transactions. Although brokers can charge whatever they want, most firms have fixed commission schedules for small transactions. These commissions usually depend on the value of the transaction and the number of shares involved.

Online Investing

Improvements in internet technology has made it possible for investors to research, analyze, and trade securities online. Today almost all brokerage firms offer online trading capabilities. Online brokerages are popular with “do-it-yourself” investors who choose their own stocks and don’t want to pay a full-service broker for these services. Lower transaction costs are a major benefit. Fees at online brokerages range from about $4.95 to $8.00, depending on the number of trades a client makes and the size of a client’s account.

Although there are many online brokerage firms, the four largest—Charles Schwab, Fidelity, TD Ameritrade, and E*Trade—account for more than 80 percent of all trading volume and trillions in assets in customer accounts.10The internet also offers investors access to a wealth of investment information.

Investing in Bonds

When many people think of financial markets, they picture the equity markets. However, the bond markets are huge estimates are that the global bond market is nearly $88 trillion.

Bonds can be bought and sold in the securities markets. However, the price of a bond changes over its life as market interest rates fluctuate. When the market interest rate drops below the fixed interest rate on a bond, it becomes more valuable, and the price rises. If interest rates rise, the bond’s price will fall. Corporate bonds, as the name implies, are issued by corporations. They usually have a par value of $1,000.

In addition to regular corporate debt issues, investors can buy high-yield, or junk bonds—high-risk, high-return bonds often used by companies whose credit characteristics would not otherwise allow them access to the debt markets. They generally earn 3 percent or more above the returns on high-quality corporate bonds.

Canadian Government Securities and Municipal Bonds

Both the federal government and local government agencies also issue bonds. The Bank of Canada sells bonds. They are viewed as default-risk-free because they are backed by the Canadian government. Bonds have maturities as long as 25 years or more. Bonds are sold in denominations of $1,000 and $5,000.

Municipal bonds are issued by provinces, cities, counties, and other provincial and local government agencies. These bonds typically have a par value of $5,000 and are either general obligation or revenue bonds.

Other Popular Securities

In addition to stocks and bonds, investors can buy mutual funds, a very popular investment category, or exchange-traded funds (ETFs).

Mutual Funds

Suppose that you have $1,000 to invest but don’t know which stocks or bonds to buy, when to buy them, or when to sell them. By investing in a mutual fund, you can buy shares in a large, professionally managed portfolio, or group of stocks and bonds. A mutual fund is a financial-service company that pools its investors’ funds to buy a selection of securities—marketable securities, stocks, bonds, or a combination of securities—that meet its stated investment goals. Each mutual fund focuses on one of a wide variety of possible investment goals, such as growth or income. Many large financial-service companies sell a wide variety of mutual funds, each with a different investment goal. Investors can pick and choose funds that match their particular interests. Some specialized funds invest in a particular type of company or asset: in one industry such as health care or technology, in a geographical region such as Asia, or in an asset such as precious metals.

Mutual funds are one of the most popular investments for individuals today: they can choose from about 9,500 different funds. Investments in mutual funds are more than $40 trillion worldwide. Mutual funds appeal to investors for three main reasons:

- They are a good way to hold a diversified, and thus less risky, portfolio. Investors with only $500 or $1,000 to invest cannot diversify much on their own. Buying shares in a mutual fund lets them own part of a portfolio that may contain 100 or more securities.

- Mutual funds are professionally managed.

- Mutual funds may offer higher returns than individual investors could achieve on their own.

Mutual Funds video: https://youtu.be/ngfKXvfzC74

8.7 Buying and Selling at Securities Exchanges

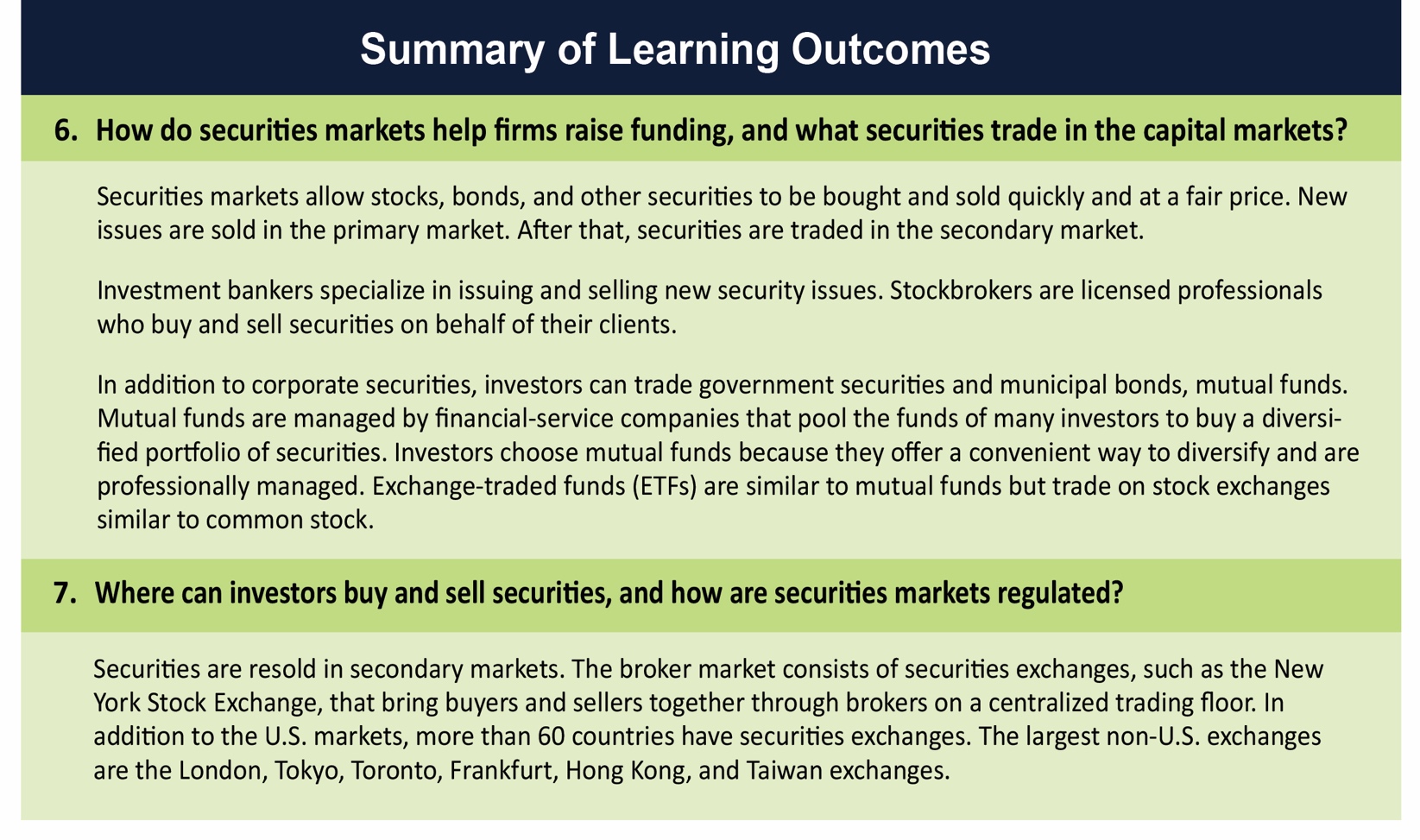

Where can investors buy and sell securities, and how are securities markets regulated?

When we think of stock markets, we are typically referring to secondary markets, which handle most of the securities trading activity. Securities trades can also take place in alternative market systems exchanges.

We present the basics of securities exchanges in this section and discuss the latest trends in the global securities markets later in the chapter.

Broker Markets

The broker market consists of securities exchanges that bring buyers and sellers together through brokers on a centralized trading floor. In the broker market, the buyer purchases the securities directly from the seller through the broker. Broker markets account for about 60 percent of the total dollar volume of all shares traded in the U.S. securities markets.

New York Stock Exchange

The oldest and most prestigious broker market is the New York Stock Exchange (NYSE), which has existed since 1792. Often called the Big Board, it is located on Wall Street in downtown New York City. The NYSE, which lists the shares of some 2,400 corporations, had a total market capitalization (domestic and foreign companies) of $25.8 trillion at year-end 2016. On a typical day, more than 3 billion shares of stock are traded on the NYSE.13 It represents 90 percent of the trading volume in the U.S. broker marketplace. Major companies such as IBM, Coca-Cola, AT&T, Procter & Gamble, Ford Motor Co., and Chevron list their shares on the NYSE. Companies that list on the NYSE must meet stringent listing requirements and annual maintenance requirements, which give them creditability. The NYSE is also popular with non-U.S. companies. More than 490 foreign companies with a global market capitalization of almost $63 trillion now list their securities on the NYSE. 14

Until recently, all NYSE transactions occurred on the vast NYSE trading floor. Each of the companies traded at the NYSE is assigned to a trading post on the floor. When an exchange member receives an order to buy or sell a particular stock, the order is transmitted to a floor broker at the company’s trading post. The floor brokers then compete with other brokers on the trading floor to get the best price for their customers.

In response to competitive pressures from electronic exchanges, the NYSE created a hybrid market that combines features of the floor auction market and automated trading. Its customers now have a choice of how they execute trades. In the trends section, we’ll discuss other changes the NYSE is making to maintain a leadership position among securities exchanges.

Global Trading and Foreign Exchanges

Improved communications and the elimination of many legal barriers are helping the securities markets go global. The number of securities listed on exchanges in more than one country is growing. Foreign securities are now traded in the United States. Likewise, foreign investors can easily buy U.S. securities.

Stock markets also exist in foreign countries: more than 60 countries operate their own securities exchanges. NASDAQ ranks second to the NYSE, followed by the London Stock Exchange (LSE) and the Tokyo Stock Exchange. Other important foreign stock exchanges include Euronext (which merged with the NYSE but operates separately) and those in Toronto, Frankfurt, Hong Kong, Zurich, Australia, Paris, and Taiwan.18The number of big U.S. corporations with listings on foreign exchanges is growing steadily, especially in Europe. For example, significant activity in NYSE-listed stocks also occurs on the LSE. The LSE also is gaining a share of the world’s IPOs. Emerging markets such as India, whose economy has been growing 6 percent or more a year, continue to attract investor attention. The Sensex, the benchmark index of the Bombay Stock Exchange, increased close to 40 percent between 2013 and 2017 as foreign investors continue to pump billions into Indian stocks.19

Why should Canadian investors pay attention to international stock markets? Because the world’s economies are increasingly interdependent, businesses must look beyond their own national borders to find materials to make their goods and markets for foreign goods and services. The same is true for investors, who may find that they can earn higher returns in international markets.